February 23, 2025 - 01:31

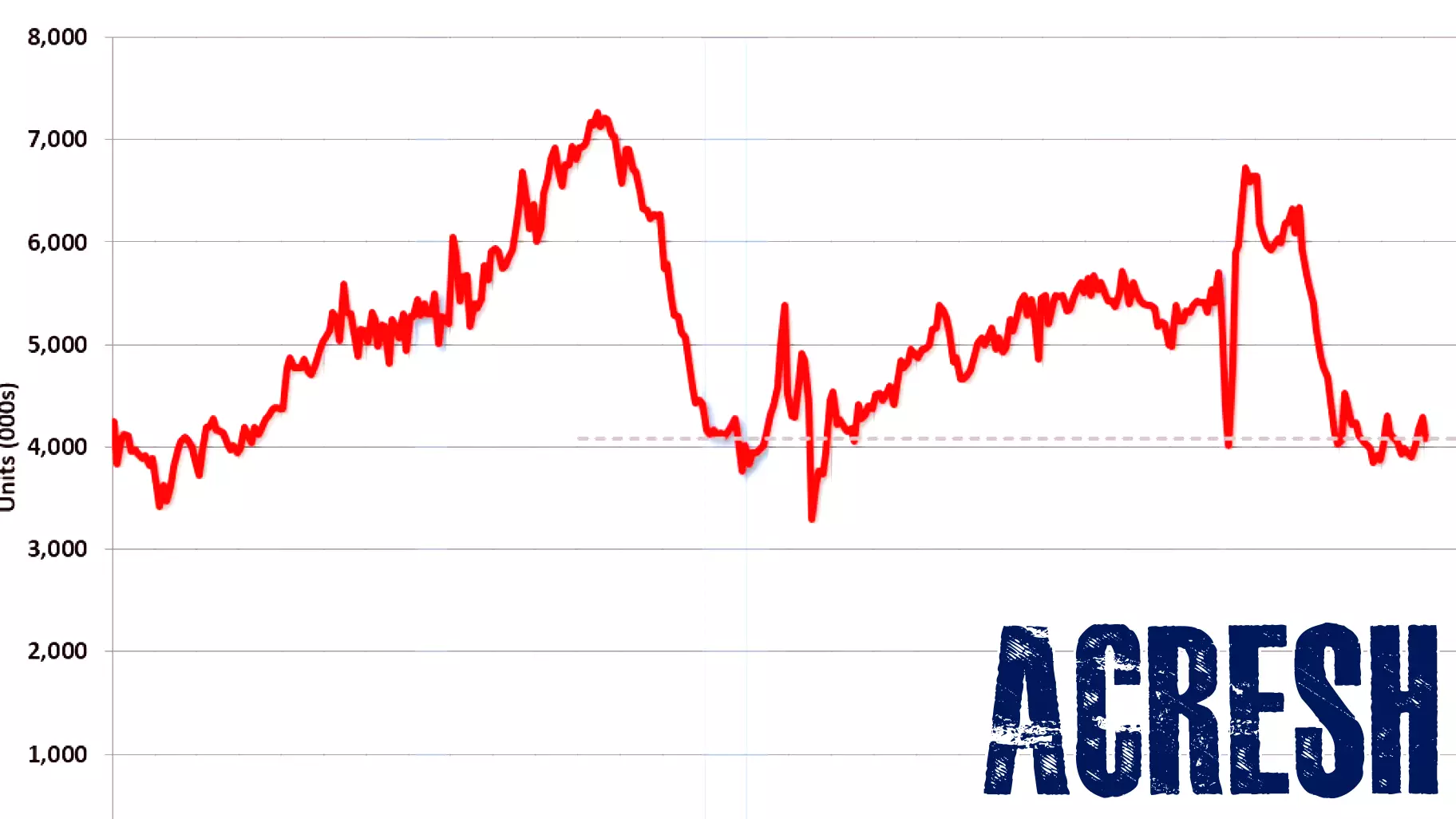

This week’s real estate newsletter highlights a concerning trend in the housing market as mortgage delinquencies have seen an increase, while foreclosure rates remain notably low. According to recent data from the National Association of Realtors (NAR), existing-home sales have dropped to a seasonally adjusted annual rate of 4.08 million units. This decline reflects ongoing challenges faced by potential homebuyers, including rising interest rates and economic uncertainty.

Despite the uptick in delinquencies, the current foreclosure rate has not mirrored this trend, remaining at historically low levels. This suggests that while some homeowners are struggling to keep up with their mortgage payments, the overall stability in the housing market is being maintained. The low foreclosure rates may indicate that lenders are working with borrowers to avoid foreclosure, providing options such as loan modifications or payment plans.

As the market continues to evolve, industry experts will be closely monitoring these trends to assess the long-term implications for both buyers and sellers in the real estate landscape.