November 28, 2024 - 17:20

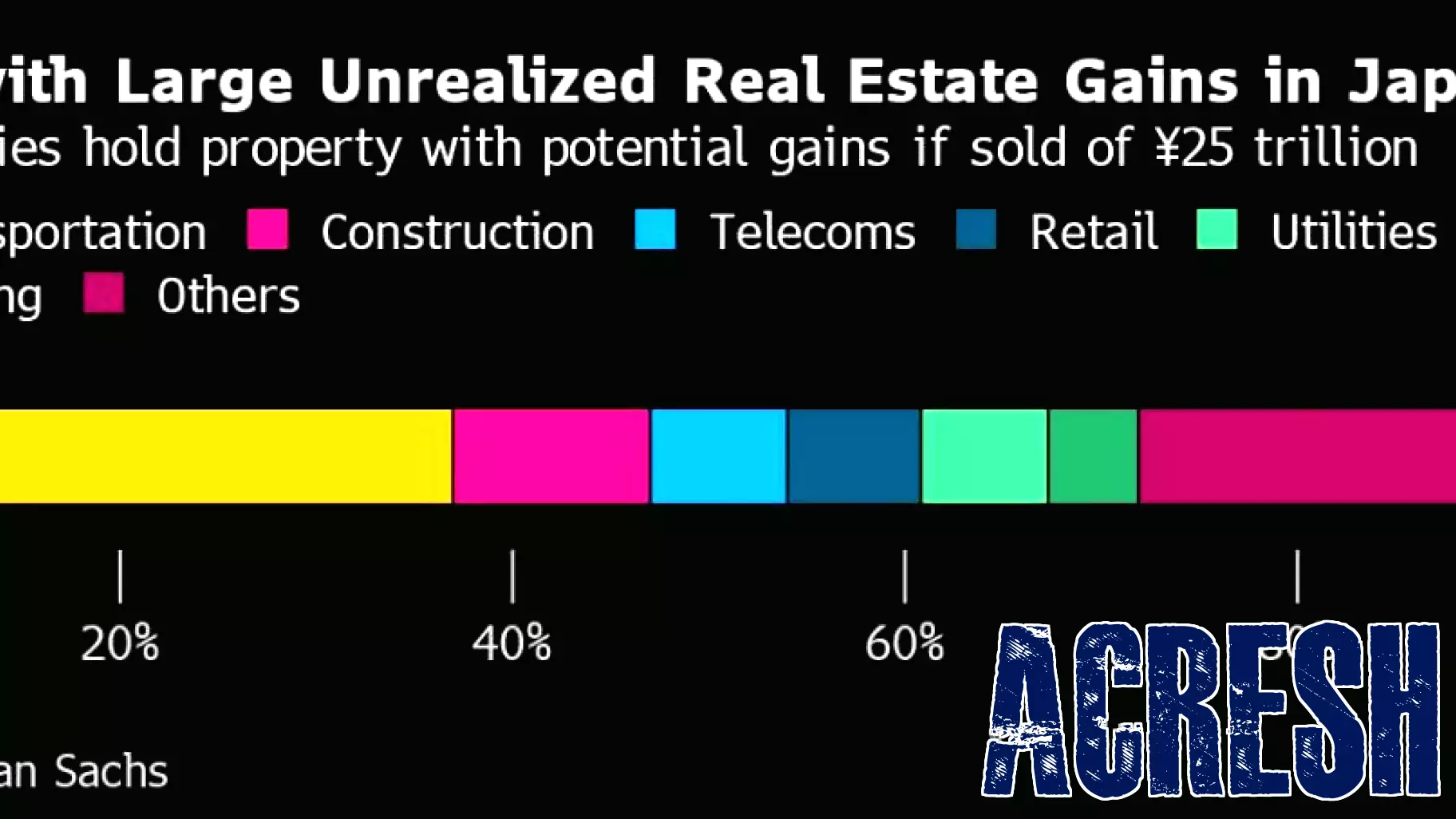

Global hedge funds and private equity firms are increasingly focusing on Japanese companies as they seek to tap into an estimated ¥25 trillion ($165 billion) in undervalued real estate assets. This surge in interest highlights a strategic shift as investors look for opportunities in markets that have historically been overlooked.

Japan's real estate market has long been characterized by a complex landscape of corporate properties, many of which are undervalued due to various factors including economic stagnation and demographic challenges. However, savvy investors are now recognizing the potential for significant returns by acquiring these hidden gems.

The influx of capital from hedge funds is expected to drive competition for these assets, potentially leading to a rise in property values. As these investment firms navigate the intricacies of Japan's real estate environment, they are poised to reshape the market dynamics, creating new opportunities for growth and development. This trend signifies not only a renewed confidence in Japan's economy but also a broader recognition of the value embedded within its real estate sector.